Nearshore Tech Talent: The Offshoring Killer

Learn how nearby talent pools offer unbeatable ROI, quality, time zone alignment and cultural fit, revolutionizing how businesses scale tech teams. ↓

Traditional offshoring to distant countries (e.g. India or the Philippines) has long been a go-to strategy for accessing tech talent at lower cost.

However, a new paradigm is emerging: nearshoring – outsourcing to geographically closer regions – is rapidly positioning itself as an alternative. Nearshore tech teams offer a blend of cost savings, high-quality talent, real-time collaboration and cultural alignment that addresses many pitfalls of classic offshoring. In fact, 80% of North American businesses are now actively considering nearshoring as a strategic option.

This post provides a detailed, marketing-oriented comparison between nearshoring and offshoring across key dimensions, backed by recent data, industry trends, and real-world success stories. The goal is clear: to illustrate why nearshore tech talent is becoming the “offshoring killer” and the preferred choice for scaling technology teams.

Nearshoring vs. Offshoring: Key Differences

Offshoring refers to outsourcing work to far-away countries (often with significant time zone gaps), whereas nearshoring means outsourcing to neighboring or nearby countries (with similar time zones). Both models seek cost-effective talent, but their operating dynamics differ greatly.

Let’s break down the comparison across critical dimensions:

Cost & ROI

Cost saving is a primary driver for both models, but nearshoring delivers better value for the money.

Offshoring to Asia/Pacific can offer rock-bottom rates – often 40–60% lower labor costs than hiring onshore (U.S./EU) according to Deloitte. Nearshore rates are slightly higher than offshore, but still dramatically cheaper than domestic hiring. For example, Latin American software engineers come at a 50–70% lower cost than U.S. developers. One case study showed a U.S. company hiring 1.5 nearshore developers for the cost of 1 onshore developer, yielding 48% cost savings.

While an offshore vendor in India might quote lower hourly rates than a nearshore vendor in Latin America or Eastern Europe, the effective ROI often tilts toward nearshore. Why? Nearshore teams tend to be more efficient (thanks to time overlap and easier communication), which cuts hidden costs like delays and rework.

“A 10+ hour turnaround time is…10+ hours too long” – Tech CEO

In short, nearshoring strikes a balance between cost and productivity: slightly higher rates than farshore outsourcing but often a lower total cost of engagement once you factor in quality and speed of delivery.

Talent Quality

Nearshore talent pools today are world-class and often equal or superior in quality to traditional offshore pools.

Latin America and Eastern Europe have invested heavily in STEM education and tech ecosystems, producing highly skilled developers.

“Latin America can be on par or higher in quality [of programmers] than India”- an analysis of Stack Overflow reputation scores.

In Eastern Europe, over 1.3 million software developers serve a booming outsourcing industry and the region’s engineers frequently rank among the top 10 globally in skill evaluations.

By contrast, sheer volume in some offshore locations hasn’t always meant quality – one study in India found only 36% of software engineering grads were able to write code that compiled. Nearshore regions emphasize both education and practical training; for instance, Mexico produces a “steady flow of qualified developers” with 3+ million STEM professionals and over 500,000 STEM students enrolling each year. Nearshore talent also often has experience with Western work culture and modern development practices, ensuring they deliver at the expected standard.

The bottom line: offshore hubs offer huge quantities of talent, but nearshore hubs offer high-quality talent with the right expertise – and enough of it to meet most needs.

Time Zone Alignment

This is arguably nearshoring’s biggest advantage over far-off offshoring.

With offshoring, companies grapple with 6–12 hour time differences, meaning teams work in shifts with little to no overlap. Nearshoring keeps teams within a 0–3 hour time zone window, allowing real-time collaboration during the workday.

The impact on productivity is profound: working near-synchronously enables Agile methods, quick feedback loops, and daily stand-ups with the remote team. According to Gartner, having a near-timezone team can increase real-time problem-solving efficiency by 25%. In practice, this means bugs get fixed the same day, ideas are discussed on the fly, and projects don’t stall waiting overnight for answers.

“… is no different than working between U.S. offices in different cities…[whereas] a 10+ hour turnaround [with India] is 10+ hours too long” – U.S. startup leader

In sum, nearshore teams operate in your rhythm, while offshore teams operate while you sleep – the former is far better for fast-paced development demands.

Communication & Cultural Fit

Proximity brings not just overlapping hours but often stronger cultural alignment and easier communication.

Many nearshore countries share cultural values or business norms with their client markets. For example, U.S. companies find Latin American teams closely align on work style and company culture – professionalism, creativity, and initiative are emphasized similarly on both sides. Language fluency is less of a barrier in nearshoring as well: English proficiency in major nearshore hubs has risen steadily and many Eastern European developers are multilingual and comfortable in English.

By contrast, offshore arrangements frequently report communication barriers due to language nuances or differing business etiquette. Miscommunications can increase project timelines by ~15–20% according to PMI studies. Cultural differences are cited by over 50% of companies as a significant challenge in offshore projects.

Nearshore teams mitigate this: working with folks in Mexico City or Kraków often feels more “in sync” with New York or London teams than working with a team halfway across the globe. A Capgemini report found 68% of companies saw improved collaboration when they shifted to nearshore partners, thanks to easier face-to-face visits and cultural familiarity. The result is clearer communication, fewer misunderstandings, and a more integrated team ethos.

Attrition & Retention

High turnover has long been a pain point in offshore outsourcing. It’s not uncommon for Indian IT outsourcing firms to experience 20%+ annual attrition in their workforce. This churn disrupts continuity – today’s developer might be gone next quarter, taking valuable domain knowledge with them.

Nearshore providers, on the other hand, tend to boast much lower attrition rates (often under 5%). For example, one nearshore firm noted their average developer tenure with a client was 3 years, with <5% yearly turnover. Another nearshore partner achieved a 100% retention rate over 2 years for a Fortune 500 client’s development team.

The reasons are multifold: nearshore developers often enjoy better working conditions, closer integration with client teams, and comparable benefits to onshore roles, leading to higher job satisfaction. Culturally, nearshore engineers may view themselves as true extensions of the client’s team (rather than replaceable contract resources), increasing their commitment.

Lower attrition means higher stability – your project isn’t constantly onboarding new people. A real-world example comes from Caterpillar Inc.’s experience: their subsidiary Solar Turbines built a nearshore support team in Latin America and was able to “keep the staff intact for the entire length of the engagement” despite an industry known for high turnover, dramatically improving service consistency.

In short, nearshoring offers far better retention, protecting your knowledge base and momentum from the disruptions of constant staff rotation that plague many offshore operations.

Scalability & Talent Pool Size

Offshoring’s traditional strength is access to huge talent pools.

India alone has an IT workforce in the millions, ready to scale up large projects quickly. Nearshore regions have smaller absolute labor pools, but this gap is closing fast. Eastern Europe’s tech talent, for instance, is “very large” and growing, with over 1.3 million developers and thousands more graduating each year. Latin America’s IT workforce is likewise expanding rapidly; governments in LATAM have made tech talent development a priority, fueling a surge of skilled graduates.

For most companies’ needs, nearshore regions offer more than enough scale – and often with easier recruiting. In a recent engagement, a Fortune 500 company tapped a nearshore partner’s “vast network of skilled IT professionals in Latin America” to scale multiple teams quickly, after struggling to hire enough qualified people locally. It’s true that if a project demands hiring hundreds of engineers in a short time, the very largest offshore hubs still have an edge in raw numbers. But nearshore outsourcing can also achieve significant scale by aggregating talent across several nearby countries or cities.

Moreover, any difference in talent pool size comes with a tradeoff: offshore might fill seats faster, but nearshore gets new team members up to speed and integrated faster, thanks to the factors above (time zone, communication, etc.). In practice, many firms find nearshore teams easier to grow because there’s less friction in onboarding and collaboration.

Integration & Management

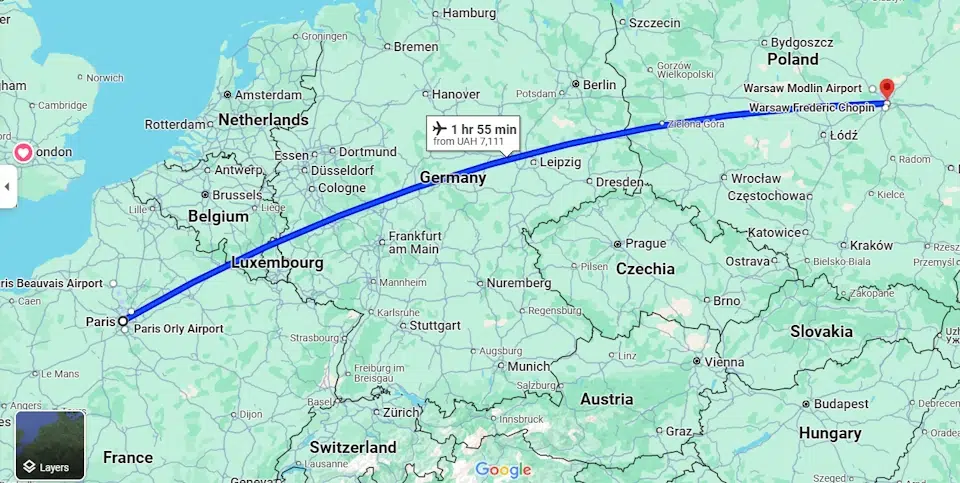

Nearshore teams integrate more smoothly into your existing operations. The ability to hop on a short flight for an in-person kickoff or quarterly sync-up builds trust and alignment in ways that a 24-hour trek to an offshore site cannot easily match.

Geographic closeness also means lower travel costs and easier onsite visits when needed (e.g. a quick trip from New York to Mexico City or from Paris to Warsaw). Beyond logistics, nearshore partners tend to share similar legal and business practices, which eases integration. For example, Eastern European countries in the EU (or associated with EU standards) adhere to strong IP protection and data security laws (e.g. GDPR).

This gives clients peace of mind when integrating nearshore developers into core projects. Managing a nearshore team often feels like managing a remote local team – overlapping working hours enable normal supervision, agile ceremonies, and direct oversight. By contrast, offshore engagements may require “robust management structures” and odd-hour coordination, which can increase oversight costs by 7–10% according to KPMG. Cultural alignment also means nearshore engineers are more likely to proactively flag issues or contribute ideas (rather than remain silent due to hierarchical cultural norms), which makes them easier to manage as true team members.

In summary, nearshoring makes external teams feel like a natural extension of your company. You get the benefits of distributed work without the alienation or silos that often come with far-off outsourcing. From a change management perspective, transitioning to a nearshore model is smoother and poses fewer integration headaches than offshoring.

Trends in Major Nearshoring Hubs

Nearshoring is not tied to one geography – it’s a global trend, with several regions rising as tech talent powerhouses serving nearby high-demand markets. Latin America, Eastern Europe and North Africa have emerged as leading nearshore regions, each with unique strengths. Below we explore recent data and trends from these hubs:

Latin America: US Tech’s Nearshore Powerhouse

For US companies, Latin America (LatAm) has become the preferred outsourcing destination for tech talent.

Proximity, overlapping time zones, and cultural affinity make LatAm a natural extension of North American teams. But just as important is the region’s explosive growth in tech expertise. Latin America’s tech outsourcing market is booming – projected to reach $27 billion in revenue by 2029. The region boasts “advanced IT ecosystems” with vibrant startup scenes and robust developer communities in countries like Mexico, Brazil, Colombia, Argentina or Costa Rica. These countries have invested heavily in tech education, producing record numbers of tech graduates and specialists. In fact, Mexico alone has over 3 million STEM professionals, and more than half a million new STEM students enroll each year – creating a continual pipeline of talent.

Latin American developers are known for being highly skilled, educated, and “career-driven”, often with strong English proficiency and familiarity with U.S. business culture. Many rank among the top in global coding competitions and skills tests. Crucially, they combine this quality with cost advantages. This hits a sweet spot – affordable rates without compromising on quality. It’s no surprise, then, that Latin America is now seen as the #1 nearshore talent pool in the world for U.S. firms.

Another trend is the diversification of services in LatAm. While software development is the flagship, companies are increasingly moving not just coding tasks but also product design, UX/UI, and other higher-value tech functions to Latin America. Government support (such as Colombia’s ICT Modernization Law to boost tech exports) and thriving innovation hubs mean U.S. businesses find nearly every capability they need across LatAm. From Mexico’s proximity and deep talent pool, to Colombia’s fast-growing IT sector, to Argentina’s and Brazil’s renowned developers, LatAm offers a range of options depending on the specific needs.

The region’s time zone alignment (mostly within 1–3 hours of U.S. time) and frequent flight connections make ongoing collaboration truly convenient

Eastern Europe: Europe’s Thriving Nearshore Engine

Eastern Europe has long been a technology outsourcing hub for Western Europe, and it continues to shine as a nearshoring favorite for both European and U.S. companies.

The region offers exceptional technical education, a large and growing talent pool, and cost-effective rates. Eastern Europe’s developer population is estimated above 1.3 million (and growing) across countries like Poland, Ukraine, Romania or Bulgaria. Nations such as Poland and Ukraine churn out tens of thousands of IT graduates annually, with strong engineering and mathematical training. This focus on quality education has made Eastern European programmers highly respected – they are often ranked among the most skilled globally, known for strong problem-solving and adherence to best practices.

In terms of cost, Eastern Europe offers a compelling advantage: companies can hire comparable talent for roughly 40% less than in Western Europe or the US. This means a developer in Ukraine or Romania might cost half of what a similarly skilled developer in Germany or the UK would command. These savings come without a drop in quality – clients often report equal or higher productivity. Culturally and geographically, Eastern Europe is well-aligned with Western Europe: teams can frequently meet in person (a short flight or train ride), and the time zone difference is minimal (usually 1–2 hours). For U.S. firms, Eastern Europe is a bit farther (5–7 hour difference from U.S. East Coast), but many still choose it for specialized skills and top-notch talent.

English proficiency is common (especially among younger professionals), and many developers speak a third language as well, reflecting the region’s multicultural history.

Key tech hubs like Poland’s Warsaw/Kraków, Ukraine’s Kyiv/Lviv, Romania’s Cluj/Bucharest, and Hungary’s Budapest have become well-established outsourcing centers. They host R&D offices for global tech giants and countless outsourcing firms. Notably, Eastern European countries maintain robust IP protection and data security standards (many are EU members or align with EU regulations), which appeals to clients concerned about confidentiality and compliance. The war in Ukraine in 2022 tested the region’s resilience, but many companies successfully redistributed work across other Eastern European locations, and demand for the region’s talent remains very high.

For European companies especially, Eastern Europe is the go-to nearshore choice – combining close time zones, cultural familiarity, and a reputation for engineering excellence.

North Africa: An Emerging Nearshore Frontier

North Africa is quickly emerging as a nearshoring hub for European companies (particularly in France, Spain, and other EU nations).

Countries like Morocco, Egypt, and Tunisia offer a unique mix of advantages: geographic proximity to Europe (often just a 1–3 hour flight away), multilingual talent (English, French, Arabic, and Spanish are common due to historical ties), and competitive costs.

Morocco, for example, has positioned itself as a leading nearshore destination in the Francophone world. The country’s IT and business process outsourcing sector employs over 120,000 people, and is growing by ~10,000 jobs per year. The Moroccan government’s strategic investments and free-zone incentives have attracted many European companies to set up IT service centers there.

Morocco has successfully positioned itself as an emerging destination in the offshoring sector, attracting subsidiaries of global enterprises.

One of North Africa’s strengths is the time zone alignment with Europe. For instance, Tunisia and Morocco share much of the workday with Central Europe, enabling real-time collaboration similar to Eastern Europe’s advantage. North African teams also often have a strong command of European languages and business etiquette, easing integration for clients in France or Spain. The cost structure is very attractive: IT services rates can range around $15–$35 per hour in many North African locations, lower than Eastern Europe on average, while still delivering solid quality. Egypt, with its large population and technical universities, is another key player – it produces a significant number of engineering graduates and has become a tech hub for Middle Eastern and European clients alike.

The region is gaining attention not just for call centers (for which it’s been known historically) but for software development, data services, and high-value engineering. Tech giants have noticed this potential: companies like Microsoft, Google, and Amazon have begun investing in Africa (e.g. Google’s $1 billion investment in African tech initiatives, which is spurring development of local tech ecosystems.

For European companies seeking nearshore solutions, North Africa offers a compelling blend of low costs, convenient collaboration, and untapped talent. While it is a bit newer on the scene than Latin America or Eastern Europe, the momentum is unmistakable. In a recent report, 4% of European firms were already considering Morocco as an alternative sourcing location, a figure poised to grow as success stories spread. North Africa’s rise expands the nearshoring map – providing yet another option for companies to find the right balance of cost, quality, and proximity in their global talent strategy.

Aside from these, other regions sometimes act as “nearshores” for specific geographies – e.g. Southeast Asia for Australia/Japan, or Canada for US companies – but the regions above represent the major nearshoring trends in the tech talent market as of today.

Case Studies: Nearshore Success Stories

Many companies have already made the leap from traditional offshoring to nearshoring – or have scaled via nearshore teams – with remarkable success. Here are a few real-world examples that highlight the value propositions of nearshore tech talent:

Fortune 500 QSR Company (Latin America Nearshore)

A global quick-service restaurant chain (Fortune 500) was struggling with rising developer costs and local talent shortages for its IT projects. By partnering with a nearshore staffing firm, the company built a software engineering team in Latin America and achieved 48% cost savings compared to U.S. hiring.

They could hire one and a half nearshore developers for the cost of one domestic developer – a huge boost to capacity within the same budget. Quality did not suffer; on the contrary, the high-caliber talent sourced through the nearshore partner delivered excellent results and integrated well with the company’s culture. Perhaps most striking was the impact on team stability: over a two-year period, the nearshore team had a 100% retention rate, with zero turnover. This level of continuity was unprecedented for the company’s tech department. The nearshore developers were happy, engaged, and committed to the client’s mission, leading to faster project completion and knowledge staying in-house.

Thanks to the nearshoring success, the company rapidly scaled up the team (growing beyond the initial pilot of 3–4 developers) and accelerated its development roadmap. This case shows how nearshoring can simultaneously address cost, scalability, and retention – something traditional offshoring struggled to deliver for the client.

Caterpillar’s Solar Turbines (Transition from Offshore to Nearshore)

Caterpillar Inc., a manufacturing giant, traditionally used offshore contractors for some of its support functions.

One division, Solar Turbines, decided to try a nearshore approach for its technical call center support. The goal was to improve responsiveness and reduce the high turnover they experienced with an offshore vendor. The company engaged a nearshore team in Latin America to support its field installers with on-demand technical assistance.

The results were impressive: the nearshore partner was able to quickly source skilled support specialists in-region and, crucially, retain them. Despite operating in an industry “known for high turnover”, the nearshore team remained intact throughout the project. Caterpillar saw dramatically lower attrition in these roles than before, ensuring that expertise and customer knowledge wasn’t constantly walking out the door. Moreover, the close time zone meant Solar Turbines’ U.S. managers could coordinate in real time with the support team, improving service quality and speed for end customers.

This case illustrates a common journey: a company burned by offshore outsourcing’s attrition and communication gaps finds a better long-term fit by moving the work closer to home. By transitioning to nearshore support, Caterpillar cut downtime, improved end-user satisfaction, and regained control over their extended team – a clear win over the previous offshore model.

German Automaker (Poland Nearshore vs. India Offshore)

A European automotive company provides a telling comparison of offshore vs. nearshore outcomes. The firm had options to develop a new IoT-based platform either with an established offshore team in India or a nearshore team in Poland. They chose Poland for closer collaboration. The nearshore Polish team worked in lockstep with the German engineers.

The result: the project was completed 40% faster than comparable projects done via offshore teams, even though the nearshore route was about 15% higher in nominal cost. The real-time collaboration, cultural alignment, and shorter feedback cycles in the nearshore setup prevented the delays and miscommunications that had hampered the offshore projects. In the end, the slightly higher hourly rate was easily offset by the faster time-to-market and superior quality.

Nearshore Wins

These examples scratch the surface – many other companies (from scrappy startups to global enterprises) have unlocked growth with nearshore tech talent. Whether it’s a Silicon Valley SaaS company partnering with developers in Colombia to iterate faster, or a European fintech augmenting its team with Romanian experts to tap specialized skills, the stories share a common theme: businesses gain competitive advantage when they leverage nearshore teams effectively.

They achieve comparable (or better) results versus offshoring, with fewer headaches and often unseen benefits like happier teams and more innovative ideas. The “offshoring killer” narrative is playing out in boardrooms: firms are realizing that nearshore models can deliver equal cost efficiency plus improvements in collaboration, quality, and retention – a combination that is hard to beat.

Friendshoring = Future

Looking ahead, the consensus is that nearshore outsourcing will continue to gain momentum.

It addresses many of the current market challenges: talent scarcity, the need for agility, and the importance of resilience (e.g., diversifying away from single-country risk). We’re seeing investments flow into nearshore destinations, further improving their capacity and infrastructure. As an example, multiple Big Tech companies opened engineering offices in Poland, Mexico, and Brazil in the last two years to leverage local talent while staying closer to their headquarters’ time zones.

Meanwhile, the concept of “friendshoring” in geopolitical discussions – favoring trade with friendly nearby countries – also aligns with the nearshoring boom, suggesting political tailwinds for such strategies.

Conclusion

In the battle of outsourcing models, nearshore has emerged as the modern, high-value option – truly an “offshoring killer”. By bringing outsourced teams closer, companies no longer have to accept the trade-offs that came with offshoring. Instead, they gain:

- Real-time collaboration and agility (no more waiting overnight for updates).

- High-caliber talent that meets Western quality standards.

- Significant cost savings (often 40–60% vs. onshore) without the hidden costs of delays or rework.

- Cultural alignment and communication ease, leading to productive partnerships.

- Lower attrition, meaning stable teams and preserved know-how.

- Scalability and integration that feel like an in-house extension rather than a distant contractor.

Nearshore tech talent hubs in LATAM, Eastern Europe and other regions are ready to deliver on these promises. They offer the best of both worlds: the cost efficiency once only found in far-off locales, plus the cohesion and effectiveness of a near-at-hand dev team. For organizations seeking to innovate faster and operate leaner, nearshoring isn’t just an alternative – it’s an advantage.

The message to take away: If you want to supercharge your tech capabilities and stay competitive, look next door – the talent you need might just be a nearshore away.

Sources

- Deloitte Global Outsourcing Survey – Key trends and regional insights.

- LinkedIn Pulse: “IT Offshore vs IT Nearshore: Which strategy wins?” – Daniel J. Jacobs.

- HatchWorks Tech Talent Report – Nearshore vs Offshore Pros/Cons.

- TECLA (Latin America IT Staffing) – “IT Nearshoring Stats.

- Jobsity (Nearshore provider) – Thought Leadership on LATAM vs India.

- MojoTrek Case Study – Fortune 500 QSR Nearshoring results.

- Sonatafy Case Study – Caterpillar Solar Turbines nearshore support.

- Relevant Software Blog – Eastern Europe outsourcing facts.

- ShiftAsia Report – Outsourcing cost by region.

- Nearshore Americas – Industry commentary on outsourcing trends and growth in LatAm vs APAC.

Note: We’ve spent a lot of time and effort creating this research. If you intend to share or make use of it in any way, we kindly ask that you include a backlink to our website – EchoGlobal.