12 Little-Known Fintech Unicorns Making Big Waves

In the rapidly evolving world of financial technology, fintech unicorns are making a significant impact by transforming how we manage, invest, and move money. ↓

While giants like PayPal and Stripe dominate headlines, a new generation of fintech unicorns is quietly fuelling transformation across financial services.

- Airwallex

- Bitpanda

- BharatPe

- C6 Bank

- Chipper Cash

- Deel

- DriveWealth

- Flutterwave

- Groww

- Jeeves

- Klarna

- Mambu

These under-the-radar companies are disrupting everything from digital banking and cross-border payments to investment platforms and payroll infrastructure.

1. Airwallex

HQ: Australia | Founded: 2015

AIRWALLEX Honest Review

Airwallex offers an end-to-end financial infrastructure for businesses engaged in international commerce. With capabilities spanning cross-border payments, foreign currency accounts, FX transactions, and multi-currency corporate cards, it provides SMEs with the same level of global financial access once reserved for enterprise giants.

Designed with developers in mind, Airwallex’s API-first architecture enables seamless integration into business platforms. It now supports transactions in over 130 countries across 50+ currencies and is increasingly becoming the backbone of international finance for startups and scale-ups.

2. Bitpanda

HQ: Austria | Founded: 2014

Bitpanda began as a cryptocurrency trading platform but quickly evolved into a comprehensive investment ecosystem. Today, it enables users to invest in everything from digital assets to ETFs, stocks, and precious metals — all under one roof.

Its B2B offering, Bitpanda White Label, powers digital asset integration for third parties, while Bitpanda Pro serves institutional and high-volume traders. With regulatory compliance at its core and user education as a key pillar, Bitpanda is helping retail investors across Europe grow their wealth safely and confidently.

3. BharatPe

HQ: India | Founded: 2018

BharatPe is a fintech trailblazer focused on empowering offline merchants across India. By consolidating various UPI payment systems into a single QR code, it has made digital transactions accessible for millions of small retailers.

Beyond payments, BharatPe has launched working capital loans, BNPL products, and investment offerings tailored to the needs of its merchant base. It plays a pivotal role in bringing financial inclusion to underserved business owners, helping them scale in a rapidly digitising economy.

4. C6 Bank

HQ: Brazil | Founded: 2018

C6 Bank is redefining personal and business banking in Brazil with a mobile-first, branchless approach. Its offerings span everything from savings and credit cards to investment services and personal loans, all designed for a frictionless customer experience.

It has also entered strategic partnerships — such as with telecom giant TIM — to cross-leverage distribution channels and deepen user engagement. C6 Bank’s mission is to democratise access to quality financial services in a region traditionally underserved by legacy institutions.

5. ChipperCash

HQ: USA | Founded: 2018

Chipper Cash is one of the fastest-growing fintechs in Africa, offering fee-free cross-border payments, mobile wallets, and cryptocurrency trading. Its simplicity and affordability have made it a go-to platform for millions of Africans — particularly those without access to traditional banking.

Chipper Cash is also tackling the remittance market by facilitating low-cost transfers from the US to African countries. As it broadens its financial services, it’s becoming a foundational layer for economic participation across the continent.

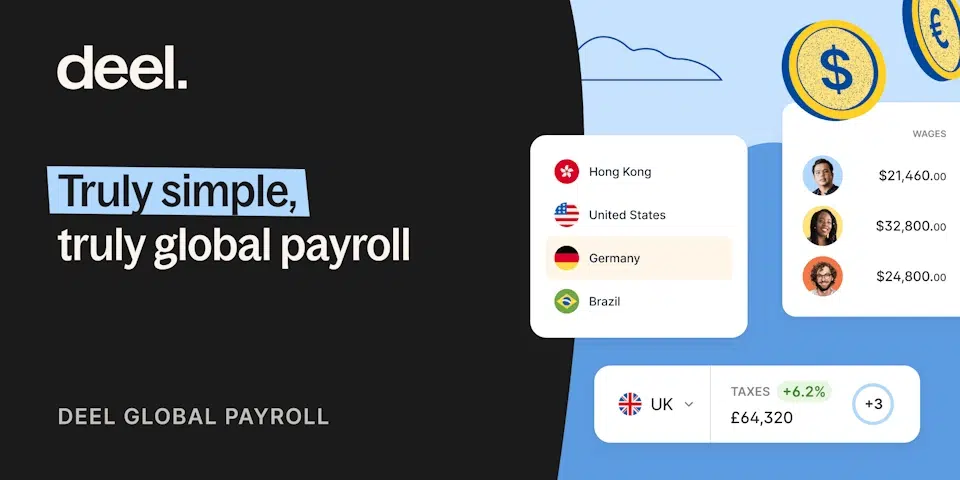

6. Deel

HQ: USA | Founded: 2018

In the remote work era, Deel has emerged as a category leader for global employment compliance. It enables companies to hire, onboard, and pay full-time employees or contractors in over 150 countries, managing payroll, taxes, and legal documentation.

With localised contracts, compliance automation, and integrations with popular HR tools, Deel makes it easy for companies of any size to scale distributed teams without the traditional administrative burden.

7. DriveWealth

HQ: USA | Founded: 2012

DriveWealth is a pioneer in embedded investing. Its platform allows fintechs, banks, and brokerages to integrate stock trading features directly into their products via API. This infrastructure enables fractional investing — a powerful inclusion tool for emerging markets.

The company’s global orientation and regulatory-first approach make it a trusted partner for those looking to offer regulated trading experiences in regions where such access was previously limited or non-existent.

8. Flutterwave

HQ: Nigeria | Founded: 2016

Flutterwave is solving Africa’s payment fragmentation problem with a unified platform that supports card payments, mobile money, and bank transfers. Its infrastructure enables cross-border commerce, helping local businesses access regional and global markets.

In addition to its flagship B2B services, Flutterwave launched Barter, a personal finance app that lets users create virtual cards and manage their spending. With partnerships spanning Visa, Alipay, and PayPal, Flutterwave is unlocking Africa’s digital economy at scale.

9. Groww

HQ: India | Founded: 2016

Groww is a user-first investment platform designed for India’s growing middle class. It offers mutual funds, Indian stocks, and ETFs, all accessible via a minimalist app that simplifies the often intimidating world of finance.

The platform places a strong emphasis on education, providing content and tools to help first-time investors build financial literacy. Regulated by SEBI, Groww is cultivating a new generation of digitally-savvy investors in one of the world’s fastest-growing economies.

10. Jeeves

Founded: 2020

Jeeves offers an all-in-one expense management platform for startups and SMEs operating internationally. Its multi-currency corporate cards, real-time spend tracking, and credit lines enable companies to streamline financial operations across borders.

With a presence in North America, Latin America, and Europe, Jeeves integrates with major accounting tools and helps businesses maintain financial control while scaling fast. It positions itself as the modern CFO’s Swiss army knife.

11. Klarna

HQ: Sweden | Founded: 2005

Klarna is arguably the most well-known name on this list — and for good reason. It reshaped consumer credit with its Buy Now, Pay Later (BNPL) model, which is now embedded into e-commerce platforms globally.

Beyond deferred payments, Klarna’s app offers budgeting tools, rewards, and personalised deals. The company is now diversifying its revenue streams through fintech services like open banking, showing its intent to evolve from BNPL pioneer to full-fledged financial platform.

12. Mambu

HQ: Germany | Founded: 2011

Mambu provides composable banking architecture that enables financial institutions to build, deploy, and scale digital banking products rapidly. Its modular, API-first platform supports everything from loans and savings accounts to full digital banks.

Used by both traditional banks and fintech challengers, Mambu’s cloud-native approach allows institutions to modernise legacy systems without rebuilding from scratch. It’s at the forefront of the shift from monolithic banking cores to agile, plug-and-play infrastructure.

Sum Up

The fintech unicorns featured in this post illustrate how next-generation companies are reshaping global finance – from frictionless payments to game-changing investment platforms. Each one addresses a specific financial challenge with innovation and agility.

Have a fintech vision but missing the tech muscle? Let’s build your team.